With macroeconomic trends pointing toward a potential lull in holiday spending, it’s more important than ever to capitalize on a Q4 Amazon strategy that will attract customers, beat competitors, and drive revenue for your brand. In addition to the standard holiday shopping events—Black Friday and Cyber Monday—Amazon has announced a Prime Early Access Sale (their second Prime Day event of the year) set to take place on October 11 and 12.

As we approach the holiday shopping season, there’s still time for Amazon sellers to apply proven tactics to their marketplace strategy, all while adapting to the current economic environment.

Check out the top strategies Amazon sellers should use to drive sales this holiday season, and effectively win over new and repeat customers headed into 2023.

October's Fall Prime Event unofficially kicked off the start of the 2022 holiday shopping season. To set your brand up for success, take a look at the data from both this summer’s Prime Day and the Fall Prime Event, as well as previous Q4 sales trends to hone in on key consumer behavior insights. Adjust your Amazon strategy accordingly, with an emphasis on inventory forecasting, keyword research, and advertising performance.

Keep in mind that almost half of Amazon consumers aren’t just shopping for others during Prime Events and the holiday season, they’re “gifting” themselves as well—which means it’s critical for most brands to take advantage of the sheer influx of traffic experienced during this peak shopping season.

Use this year's Prime Day events as a crash course when laying out your holiday sales strategy: What worked, what didn’t, and what could you have done better? Did consumers behave the way you predicted, or do you need to make some changes (to your stock, product assortment, shipping methods, advertising, marketing/branding)? It’s also important to dive into any customer feedback you’ve received during both Prime Day events and optimize your product listings now for an improved customer experience. Insights from the Fall Prime Event should inform your marketplace strategy for the rest of Q4 and Q1 2023.

Use this year's Prime Day events as a crash course when laying out your holiday sales strategy: What worked, what didn’t, and what could you have done better? Did consumers behave the way you predicted, or do you need to make some changes (to your stock, product assortment, shipping methods, advertising, marketing/branding)? It’s also important to dive into any customer feedback you’ve received during both Prime Day events and optimize your product listings now for an improved customer experience. Insights from the Fall Prime Event should inform your marketplace strategy for the rest of Q4 and Q1 2023.

Start testing messaging, keywords, and graphics on your listings as soon as possible. Consider utilizing Amazon’s Manage Your Experiments feature to run A/B tests on your product photography, titles, and A+ Content so you can understand which tactics will most resonate with your audience and increase conversion. Monitor results of these tests so you can keep top performers live throughout the holiday season.

Make sure that your product listings are optimized for mobile users—86% of consumers plan to do their holiday shopping from their phones, so a mobile-first strategy for content including titles, A+ Content, and bullets will be essential.

For Amazon Ads, here are a few of our top recommendations:

From new inventory categories and new shipment workflows, to constantly keeping up with ongoing supply chain issues and shifting consumer behaviors, Amazon inventory management is evolving every day.

Facing supply chain and sell-through woes, or issues with stock limits? Here’s what we recommend for the inventory you currently have on hand:

As you prepare for the influx of holiday shopping, you may also consider switching your fulfillment strategy to FBA if you haven’t already. SupplyKick’s take: FBA is the most cost-effective solution for Amazon sellers out there right now, with the most expansive warehouse network available. If you’re not currently leveraging FBA, consider it now or as a 2023 goal.

Our team has also been exploring Buy with Prime, which is a new way for D2C brands to leverage the FBA network even more—and get more “bang for their buck” as far as any Amazon FBA fees/management go. Buy with Prime gives Amazon the ability to manage the entire order and fulfillment process on D2C websites so that the brand doesn’t have to, which can help brands sell even more of their Amazon inventory with purchases made directly on their D2C site.

And if you’re contemplating making the switch from Vendor Central to Seller Central, post-holiday season is the time to take action.

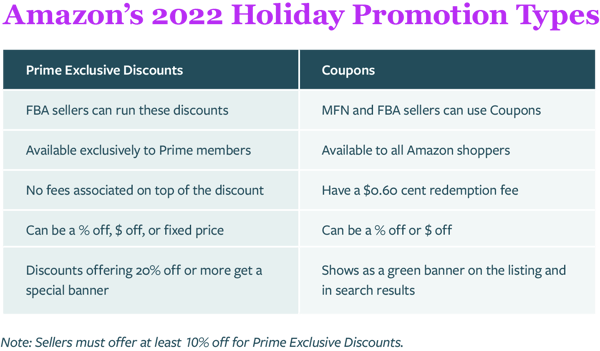

On previous Prime Days, our team has found that products with a Prime Exclusive Discount saw up to a 5x increase in sales compared to products that didn't feature a discount. And Amazon has reported that even non-promoted products saw a 19% increase in median sales during Prime Day for brands running promotions with any Amazon Ads solution.

Consider running holiday-specific promotions to drive sales for your top products. Make sure to review the deal types that Amazon offers during the holiday shopping season:

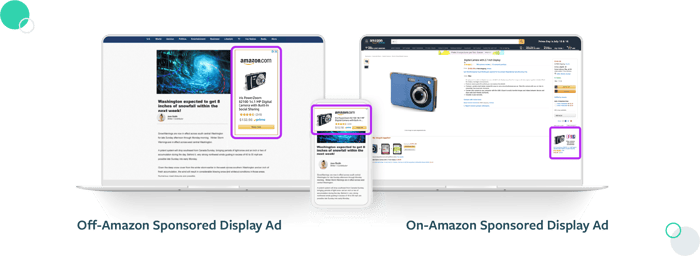

Influencer marketing, social media, Sponsored Display, and other forms of off-platform traffic can be just as important in driving traffic to your listings as on-platform advertising. In a recent SupplyKick survey, 66% of consumers said they’ve purchased a product on Amazon after seeing it on Google, Facebook, Instagram, TikTok, etc.

Amazon is supporting the off-platform traffic trend: All Brand Registered sellers on Amazon US are eligible to enroll for Amazon’s Brand Referral Bonus program. On average, brands are credited with an average of a 10% bonus from each sale driven by non-Amazon marketing efforts. Brand Registered sellers can also take advantage of Amazon Attribution analytics to track off-platform conversions.

Direct customers to your Amazon Store from your brand’s website and social channels, and engage any social influencers and organizations who have a community of followers that fall right in line with your target audience. If you’re launching new products during the holiday season, also consider enrolling in the Amazon Vine program to grow your views and reviews.

Direct customers to your Amazon Store from your brand’s website and social channels, and engage any social influencers and organizations who have a community of followers that fall right in line with your target audience. If you’re launching new products during the holiday season, also consider enrolling in the Amazon Vine program to grow your views and reviews.

Treat your brand’s Amazon Store like a brick-and-mortar storefront by creating visually compelling seasonal or holiday-specific content. During the Fall Prime Event and throughout Q4, reposition products as holiday gifts or even gift bundles. SupplyKick partners have seen up to a 30% increase in sales per visitor attributed to their Amazon Storefronts.

After implementing your seasonal Storefront content, take advantage of Amazon’s Stores Insights to monitor Storefront-specific traffic and sales. As with all other marketplace content, test and make adjustments to your Storefront as the holiday season progresses, and leverage what you learn to put together your 2023 Storefront, product assortment, and creative as well.

Finding yourself saying “bah, humbug!” as you start thinking through your holiday sales strategy? SupplyKick can help.

Since 2013, we’ve been working with partners to simplify their ecommerce selling experience on Amazon, Walmart, and beyond. We’ll take the daily grind of Amazon management off your plate so you can focus on other aspects of your business. Connect with our team to start a conversation about your Amazon strategy and subscribe to our newsletter for the latest marketplace news and trends.

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Sign up to receive our newsletter for growth strategies, important updates, inventory and policy changes, and best practices.

These Stories on Advertising

For press inquiries, please contact Molly Horstmann, mhorstmann@supplykick.com