Earlier in 2019 there was a major glitch in the Amazon world when Amazon stopped placing purchase orders to thousands of brands through Vendor Central, and many companies were faced with the question of what to do next. In particular, the question of how to transition from first-party selling to third-party selling on Amazon was a major topic of discussion for a long time.

First, we should define the difference between first-party (1P) selling and third-party (3P) selling on Amazon. First-party selling occurs through the Vendor Central platform, and Amazon places purchase orders for product which it then resells under the moniker “Amazon.com”. Third-party selling occurs through Seller Central, and brands have to manage their own marketing, advertising, inventory, pricing, customer service, etc. While third-party selling gives brands more control over how their products are represented on Amazon, it also requires a lot more work to manage.

When considering the switch to Seller Central and the 3P model, brands have three options:

Here is a breakdown of the pros and cons of each.

Companies frustrated with inconsistent communication and charge-backs from Amazon Retail may be excited to take Amazon into their own hands. There is no denying that the 3P-selling model provides brands more control over their Amazon presence, and brands will likely see an improvement in margin over wholesale prices since they are selling directly to the end-consumer.

>However, what brands may gain in margin they will have to make up in time and effort. While Amazon handles day-to-day operations in the 1P model, a brand is expected to take full responsibility of its products on Amazon in the 3P model. This means all product content, photography, advertising, logistics, customer service, pricing, reporting, and other tasks are in the hands of the brand. Without a full-fledged e-commerce team, these responsibilities can quickly become overwhelming.

Two areas where new 3P accounts really struggle is advertising and fulfillment. On Amazon, it’s essential to maintain prime-eligible status for every product in a brand’s portfolio. If products are not prime-eligible, it becomes easy for competitive products to start picking off sales. If a brand decides to utilize “fulfilled by Amazon” (FBA) to meet prime-eligibility, they should be prepared to pay additional fees on every transaction as well as long-term storage costs. ]\Additionally, in the 3P model, brands are responsible for keeping their products in stock by performing their own inventory forecasting.

In the 1P model, Amazon manages advertising to maximize sales. However, in the 3P model, brands without a dedicated Amazon PPC team are at an immediate disadvantage. Amazon is clearly placing an emphasis on advertising revenue and continues to roll out new features related to advertising, including more sophisticated bidding tactics and competitive targeting. For brands not used to or not comfortable navigating Amazon’s advertising features, it can be difficult to get products in front of the right audience.

Instead of managing their own seller account, a brand can decide to “outsource” its Amazon presence by selling to other third-party sellers. A brand can return to selling products wholesale, and these sellers can manage all of the day-to-day tasks on Amazon listed above.

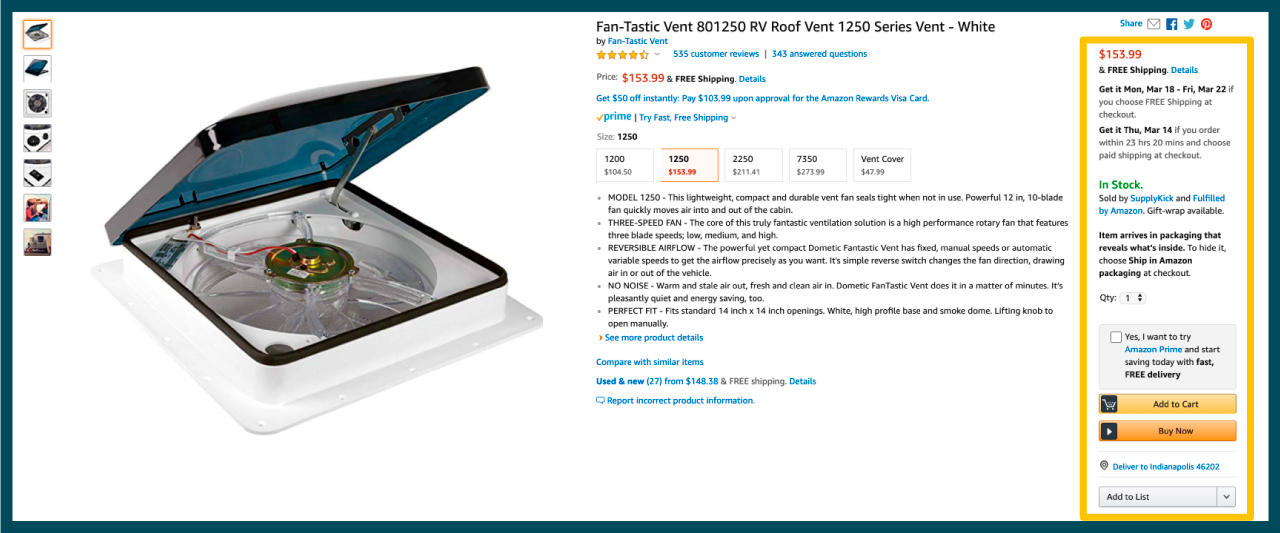

A traditional retail mindset says that the more stores selling your product, the better. However, Amazon’s construction makes selling to multiple third-party sellers problematic. Because multiple sellers can list a product on the same detail page, these sellers are often incentivized to compete on price to win the Buy Box. The Buy Box is the “add to cart” button on the right side of an Amazon detail page. It’s estimated that 85 - 90% of sales go through the Buy Box (indicated in yellow below).

Obviously, price competition on a single product is bad for a brand. Over time, a product becomes devalued due to multiple sellers constantly lowering the price, which can come back to hurt brands who have their own e-commerce channels or brick and mortar retail relationships. Selling to multiple third-party sellers is by far the least effective option for a brand wishing to transition to the third-party model.

Obviously, price competition on a single product is bad for a brand. Over time, a product becomes devalued due to multiple sellers constantly lowering the price, which can come back to hurt brands who have their own e-commerce channels or brick and mortar retail relationships. Selling to multiple third-party sellers is by far the least effective option for a brand wishing to transition to the third-party model.

In contrast to selling to multiple 3P sellers, selling to a single 3P seller allows a brand to outsource its Amazon presence without incurring any of the price competition issues mentioned above. For many brands dealing with Vendor Central issues, this option is most similar to selling directly to Amazon.

However, not all 3P sellers are created equal. Brands should identify a 3P seller who is a true partner for your Amazon strategy, with the long-term interests of the brand in mind. This includes adhering any seller agreements the brand might have, maintaining price consistency, and growing the brand’s sales through marketing and advertising. Remember, customers on Amazon associate their purchase experience with the brand, not the seller; picking a poor selling partner can have serious consequences on brand equity and reputation.

Luckily, there are a few ways to identify a strong selling partner. Here are some questions brands should be asking any potential third-party seller:

Choosing a single, third-party seller is a big decision, so it’s essential to research all options. At the end of the day, a good third-party seller should understand your brand and goals, act as an extension of your team, and help grow your Amazon sales.

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Sign up to receive our newsletter for growth strategies, important updates, inventory and policy changes, and best practices.

These Stories on SupplyKick

For press inquiries, please contact Molly Horstmann, mhorstmann@supplykick.com